Free Guide

How To Build $5,000+ in Monthly Retirement Income Without Losing Access to Your CPF

How Many Singaporeans in The Final Pre-Retirement Phase Are Creating Reliable Sources of Passive Income Without Permanently Locking Their Savings In The Enhanced Retirement Sum

REQUEST MY E-COPY

Receive your copy via Whatsapp

ENTER YOUR INFO BELOW TO RECEIVE YOUR COPY VIA WHATSAPP

Our financial consultant will reach out to you shortly upon submission.

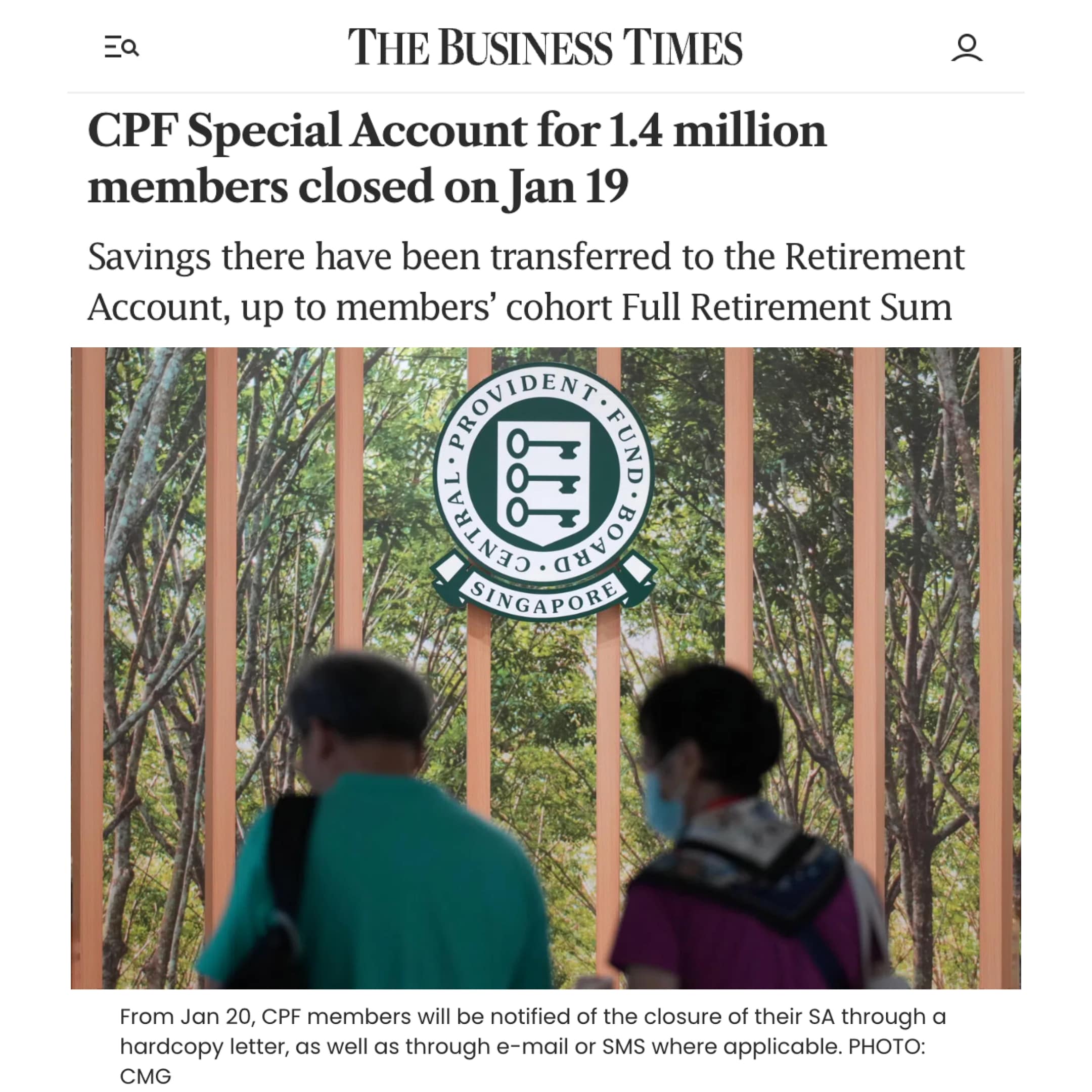

“CPF Special Account for 1.4 million members closed on Jan 19” – January 19, 2025, The Business Times

What will this mean for your retirement?

The CPF Special Account (SA) at 4% interest has now been closed for those aged 55 and above, shifting your funds to the Ordinary Account (OA) at just 2.5% interest.

This means your interest earned will drop from 4% to 2.5% as funds shift from SA to OA, directly impacting your retirement plans by reducing your income.

This shift isn’t just numbers—it’s about the years of planning and dreams that could now be compromised.

If you’ve planned your retirement around the 4% SA interest, this change could significantly derail your financial security.

It’s essential to reassess your retirement strategy immediately.

So, what’s your next move?

While you can still earn 4% in your Retirement Account (RA) by contributing more to the Enhanced Retirement Sum (ERS), now four times the Basic Retirement Sum (BRS).

RA contributions are permanent, and cannot be withdrawn, unlike the Special Account.

This means you’ll be unable to access your funds in emergencies or support your family when they need it most.

But what if there is a way to secure a comfortable retirement income without locking your cash permanently?

Introducing our FREE Guide that helps you secure $5,000 or more in monthly payouts during your golden years while maintaining financial flexibility.

If you have over $300k in CPF OA and SA combined, this guide is for you.

Discover the strategies that informed Singaporeans above 55 are implementing right now.

Act fast. Download your FREE Guide today to ensure a comfortable retirement while keeping your options open.

Dive into our upcoming guide featuring

options that Singaporeans turning 55

are considering…

Discover how other Singaporeans are adapting to the Jan 2025 CPF changes to secure $5,000+ monthly retirement income without locking their cash permanently in CPF.

Why topping up to the Enhanced Retirement Sum might not be your best move—and the alternative that offers both high returns and liquidity.

The CPF SA closure is imminent—How to reposition your funds for maximum returns while you still can.

Don’t let the 2025 CPF changes catch you off guard—download the guide to stay one step ahead.

REQUEST THE GUIDE ON HOW TO BUILD $5,000+ IN MONTHLY RETIREMENT INCOME WITHOUT LOSING ACCESS TO YOUR CPF

REQUEST MY E-COPY

Adapt your retirement strategy to these CPF changes and get back on track!

ABOUT REGAL WEALTH PARTNERS

With over 59 years of combined experience, Regal Wealth Partners has served more than 497 clients on their financial journey.

Our advisors manage a collective portfolio of over $102 million, predominantly serving Accredited Investors as defined by MAS which requires an individual to meet at least one of the following criteria:

- An income exceeding $300,000 in the past 12 months

- Financial assets surpassing $1 million

- Personal assets worth more than $2 million

We specialise in advising mass affluent and HNW clients, providing tailored strategies and solutions that bypass common mass market pitfalls. We adopt a holistic planning approach to build assets, minimise liabilities and risks, and ride through market volatility to outperform the broad market.

We protect clients from product pushing and short-term distractions, focusing on key objectives and needs. Our strength lies in understanding our clients deeply, addressing unspoken objectives, and ensuring a meaningful impact on their portfolios.

At Regal Wealth Partners, we guide clients towards prudently achieving their ultimate financial goals.

REQUEST MY E-COPY